Breakout Confirmed

We’ve been expecting stocks to continue their trend higher, but the S&P 500’s move above 4,200 was important. The S&P has closed above this level for two consecutive weeks now, suggesting the strength it has shown in 2023 is legitimate and more gains could be ahead.

- The stock market rally continued as the S&P 500 closed above the critical 4,200 level.

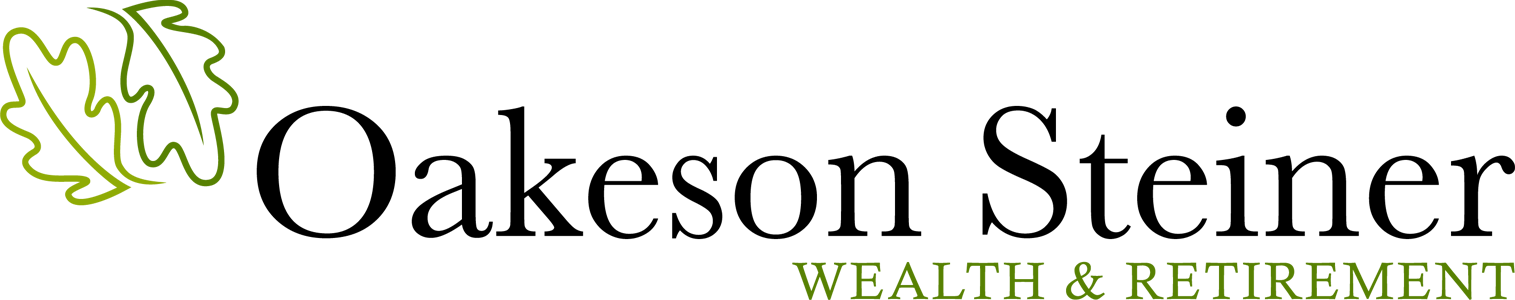

- Historically, June is not a great month for stocks, but a positive start to the year can lead to continued strength.

- Recent economic data do not point to a recession. Instead, the economy is showing resilience.

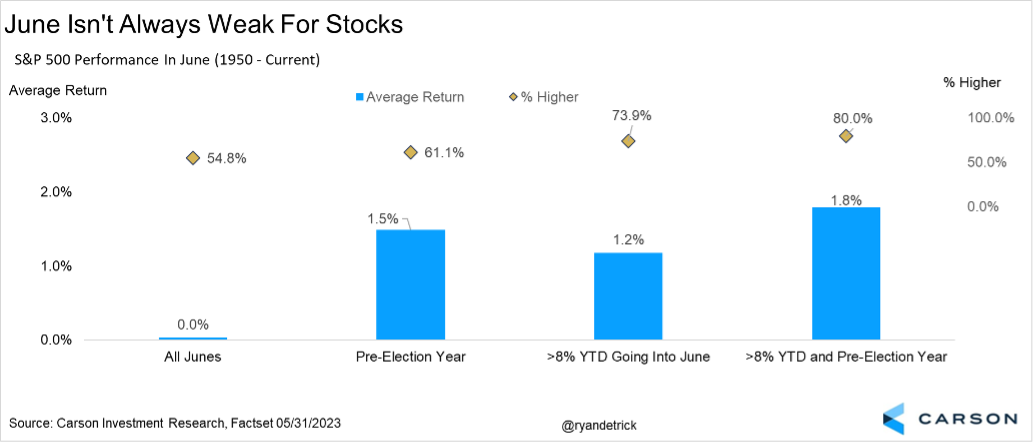

- The economy created 339,000 jobs in May, beating expectations for the 14th consecutive month.

- The unemployment rate rose to 3.7%, but other measures suggest this is the best labor market in two decades.

- Overall, the labor market remains strong, albeit less tight as wage growth moderates.

Some investors are downplaying the rally, arguing it is due to performance from a handful of stocks. While we disagree with this assessment overall, tech and communications indisputably have had wildly outsized gains versus other sectors. However, in the second half of the year, we expect investors to realize the economy is not headed for a recession (more on that below), which should help broaden the bull market. Last week, sectors such as financials, industrials, and small-caps performed quite well, and we expect this to continue.

Historically, June can be weak for stocks. The S&P 500 has gained only 0.03% on average and is higher about 55% of the time. With stocks up close to 12% for the year, some type of seasonal June weakness shouldn’t be surprising. Nonetheless, market strength heading into June can lead to continued bullishness. In fact, when the S&P 500 is up more than 8% at this point in the year, June gains 1.2% on average. During a pre-election year, that jumps all the way to 1.8% and the S&P is higher 80% of the time.

A Resilient Labor Market = A Resilient Economy

Another month, another employment surprise.

Economists expected payrolls to grow by about 187,000 in May. That’s a solid job growth number but a step down from reports through April. However, actual payroll growth beat expectations for the 14th straight month.

The economy created 339,000 jobs in May, which was close to double expectations. Better still, payroll growth in March and April was revised higher by a total of 93,000!

- March payrolls were revised up by 52,000 — from 165,000 to 217,000.

- April payrolls were revised up by 41,000 — from 253,000 to 294,000.

Two months of payroll data have been reported since the Silicon Valley Bank crisis in March, and nothing suggests weakness arising from the banking crisis.

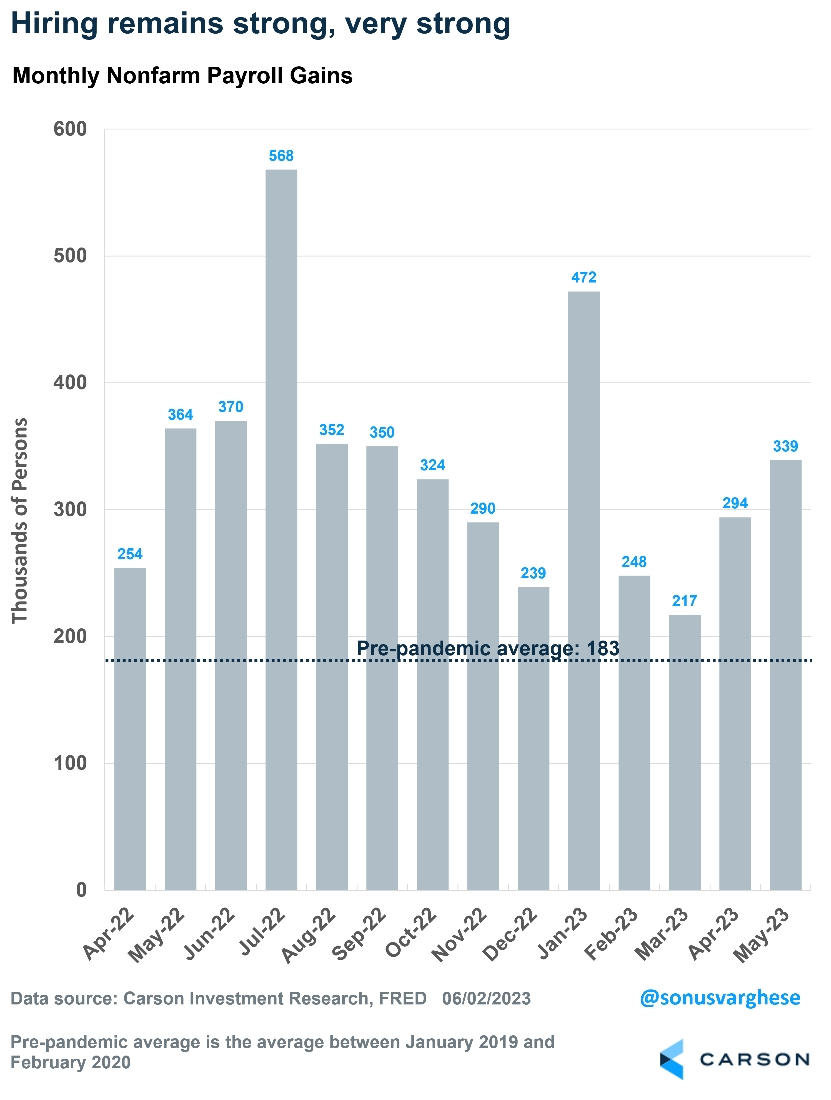

Over the first five months of the year, the economy added 1.5 million jobs. That is a strong indicator for how the economy is doing. For perspective, the average annual payroll growth between 1940 and 2022 was 1.5 million. During the last expansion, 2010-2019, average annual payroll growth was 2.2 million per year.

But What About the Unemployment Rate?

The unemployment rate rose from a 50-year low of 3.4% to 3.7%. This is cause for some concern, but digging through the data suggests it may be noise more than anything else.

It helps to understand that the job growth and unemployment rate data have different sources. The former comes from a survey of 120,000+ businesses about their recent hiring. The latter comes from a survey of about 60,000 households about their employment status. No surprise, the latter is noisier.

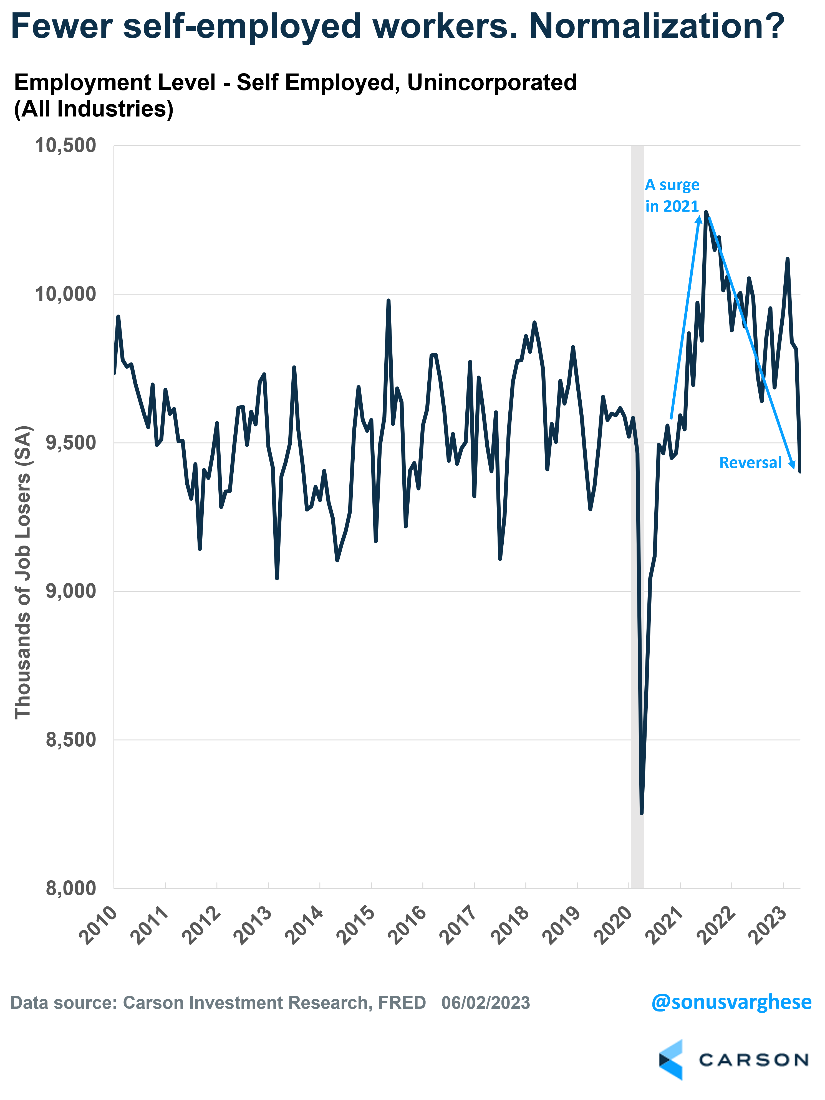

A big reason for the weak household survey (and rising unemployment rate) is that more than 400,000 people who were self-employed said they were no longer employed. As the following chart shows, this is very noisy data, but the trend seems to be toward lower self-employment. This is reversing the 2021 trend when self-employment surged. What we’re seeing now may simply be normalization of the labor market as more workers move from self-employment to W2 jobs with an employer.

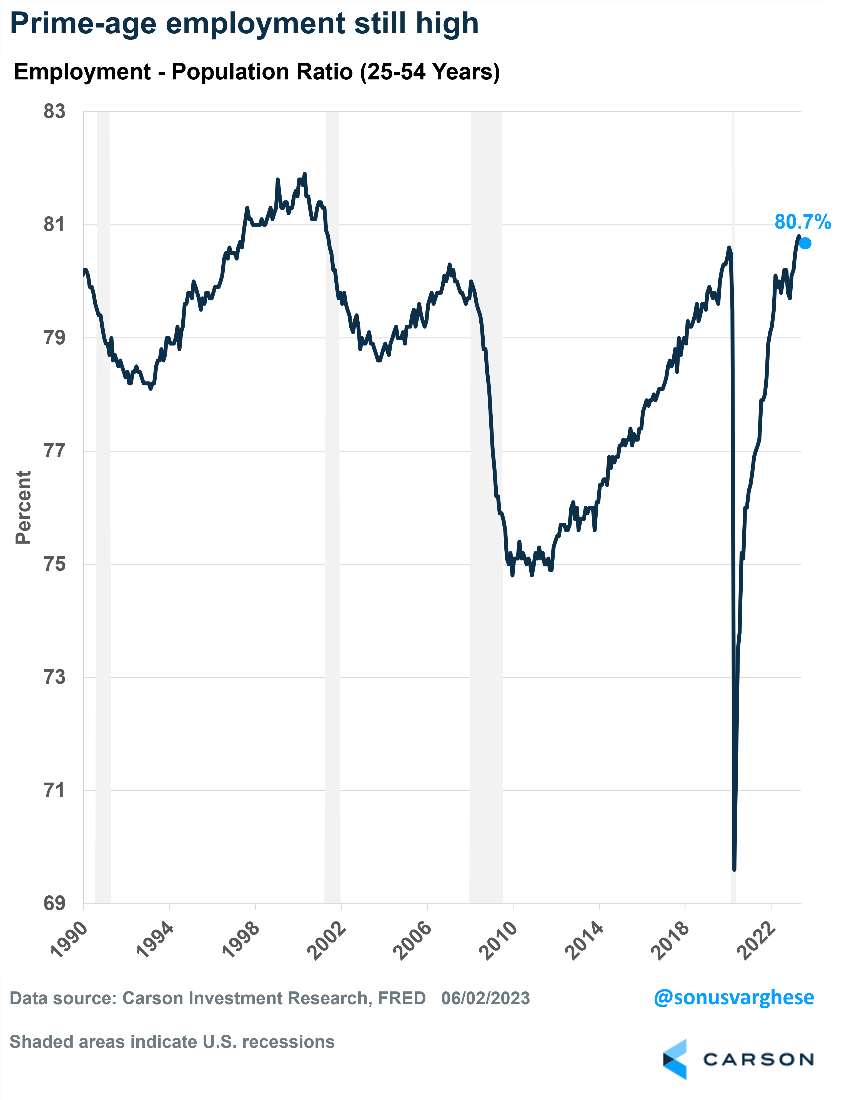

The unemployment rate can also be impacted by people leaving the labor force (technically defined as those “not looking for work”) and an aging population. We’ve previously discussed getting around this by looking at the employment-population ratio for prime age workers, i.e., workers aged 25-54 years. This measures the number of people working as a percentage of the civilian population. Think of it as the opposite of the unemployment rate. Prime age also circumvents demographic changes.

The good news is that the prime-age employment-population ratio dropped only a tick, from 80.8% to 80.7%. This still leaves it higher than at any point between 2002 and 2022.

All in all, the labor market remains strong and resilient, despite the recession calls. Perhaps it’s not as strong as the headline payroll growth number of 339,000 suggests, but any number above 150,000 would be good at this point. And we’re certainly well above that.

In fact, looking at the job growth and employment-population data, this labor market is probably the strongest seen since the late 1990s. Our view has consistently been the economy can avoid a recession this year, and nothing we’ve seen to date suggests we need to reverse course. Far from it.

This newsletter was written and produced by CWM, LLC. Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. The views stated in this letter are not necessarily the opinion of any other named entity and should not be construed directly or indirectly as an offer to buy or sell any securities mentioned herein. Due to volatility within the markets mentioned, opinions are subject to change without notice. Information is based on sources believed to be reliable; however, their accuracy or completeness cannot be guaranteed. Past performance does not guarantee future results.

S&P 500 – A capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

The NASDAQ 100 Index is a stock index of the 100 largest companies by market capitalization traded on NASDAQ Stock Market. The NASDAQ 100 Index includes publicly-traded companies from most sectors in the global economy, the major exception being financial services.

A diversified portfolio does not assure a profit or protect against loss in a declining market.

Compliance Case # 01787581